Unlocking Family Wealth

Contents

Executive Summary

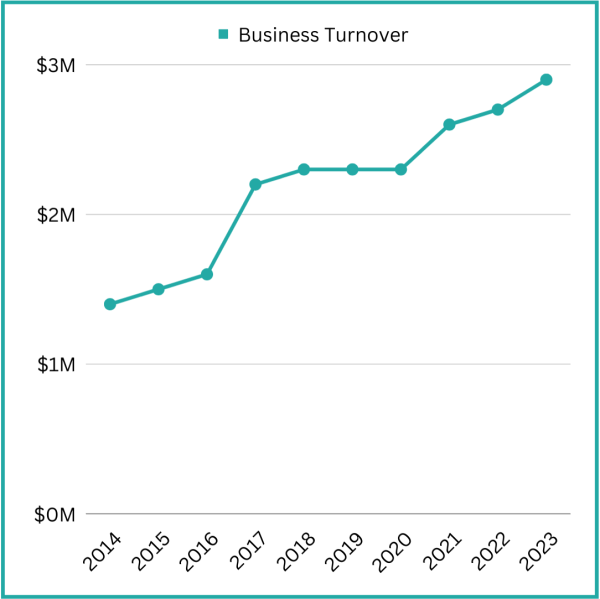

This case study tells the inspiring story of a family-owned earthmoving, civil contracting, and rail maintenance business that underwent a remarkable transformation with the assistance of HK Partners, a trusted accounting and advisory practice.

With over 20 years of industry experience, the business faced numerous challenges, including an inefficient tax structure, inadequate asset protection, and limited wealth accumulation. However, with the guidance and expertise of HK Partners, a tailored and comprehensive approach was implemented to address these issues and unlock the full potential of the family's financial journey.

Introduction

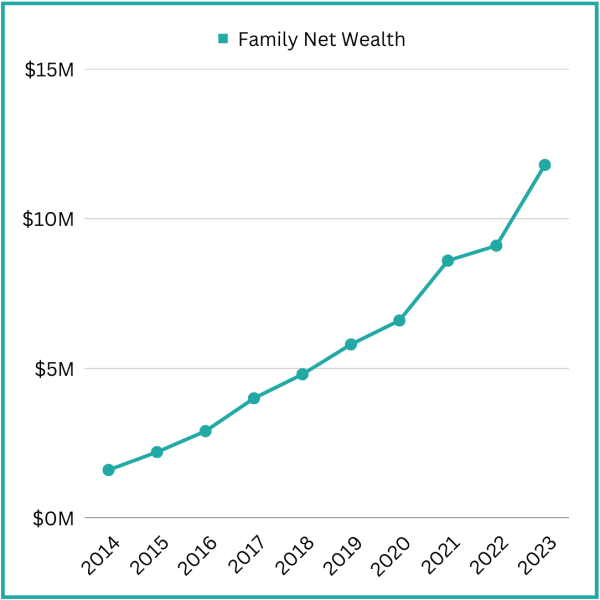

At the outset, the business's financial landscape appeared challenging. The family's wealth was below $2 million, and the existing partnership structure posed obstacles to tax efficiency and asset protection. Debt on the family home, and a commitment to privately educating four children added to their financial burdens, while a lack of investments and superannuation further restricted their wealth-building potential. In addition, inefficient management accounting software hindered their ability to effectively manage cash flow, and the absence of estate planning documents and personal insurances exposed the family to unnecessary risks.

Understanding the families' needs

HK Partners demonstrated their capabilities and unwavering commitment, effectively addressing each of the challenges faced by the family business.

Through an extensive meeting process, they gained a deep understanding of the family's goals, concerns, and aspirations.

Mapping out a client journey over a strategic timeline of 1, 3, 5, and 10 years, HK Partners worked closely with the family members to refine their objectives and prioritise crucial action points.

Reviewing the Business Operations

HK Partners commenced their excellent, personalised service by conducting a comprehensive review of the client's tax and compliance requirements. Fixed pricing engagements were provided to ensure transparency and certainty in delivering these essential services.

Moreover, a smooth transition from the previous accounting software to Xero, a more efficient and user- friendly platform, was facilitated. Templated reports were established within Xero to enable better financial reporting and analysis, while extensive bookkeeping training and support were provided to empower the family in managing their finances effectively.

To tackle the challenges related to cash flow and asset finance commitments, HK Partners established reliable cash flow reporting systems.

Regular face-to-face meetings allowed for a thorough assessment of business performance and cash flow, facilitating informed decision- making. Scenario analysis was conducted to evaluate the profitability of contracts and the potential acquisition of new machinery. Working closely with asset finance specialists, HK Partners facilitated the procurement of finance facilities to streamline the process of acquiring new equipment.

Investment Management

Recognising the importance of wealth building and long-term financial security, HK Partners introduced the family to financial planners. They attended all meetings and collaborated closely to develop a comprehensive wealth-building plan tailored to the family's goals and risk tolerance.

As part of this process, a self- managed super fund (SMSF) was established, with HK Partners providing essential compliance administration services.

This included facilitating the acquisition of investment property within the SMSF, fostering diversification and long-term growth.

Personal Insurances

Understanding the need for comprehensive risk mitigation, HK Partners engaged external risk advisory specialists to conduct a thorough review of the family's personal insurance requirements.

Working together, they facilitated the implementation of appropriate policies, offering peace of mind and safeguarding the family's financial well-being.

Ongoing collaboration with the risk advisors ensured that the policies remained up to date and aligned with the family's evolving needs.

Group Structure

The complex group structure of the business required careful analysis and optimisation. HK Partners conducted a detailed review to identify tax and compliance efficiencies and assess the alignment with intergenerational wealth transfer goals.

By collaborating with specialist tax and estate planning lawyers, HK Partners developed a strategy to restructure the group effectively. Ultimately, the business was split into three new companies: operating, asset holding, and employment. This restructuring process not only enhanced tax efficiency but also significantly reduced risk across the group.

Estate Planning

Recognising the importance of comprehensive estate planning, HK Partners guided the family in preparing wills, enduring powers of attorney, and enduring guardianships.

Working closely with specialist tax and estate planning lawyers, they ensured the creation of robust and up-to-date documents. Regular reviews were conducted to accommodate significant life events and adapt the estate planning strategy accordingly.

Ongoing Tax and Compliance

HK Partners continued to provide ongoing support by managing the family's tax and compliance obligations on a quarterly and annual basis. Detailed forward tax planning, with a focus on mapping out tax obligations 20 months in advance, enabled proactive and strategic financial management.

Conclusion

As a result of HK Partners' dedicated efforts, the family's wealth grew from less than $2 million to over $11 million. The business became highly profitable, thanks to the streamlined operations and efficient group structure. Risk across the group was significantly reduced through strategic restructuring, while the investment portfolio was diversified across various asset classes to align with the family's goals and risk tolerance.

Most importantly, the family now has a high level of confidence in their wealth and estate planning, providing them with peace of mind and long- term financial security.

This case study showcases the critical impact that a comprehensive and tailored approach to accounting and advisory services can have on transforming a family business and achieving financial goals. Through the expertise and collaboration of HK Partners, the client experienced a remarkable journey from financial challenges to prosperity, setting the stage for a promising future.